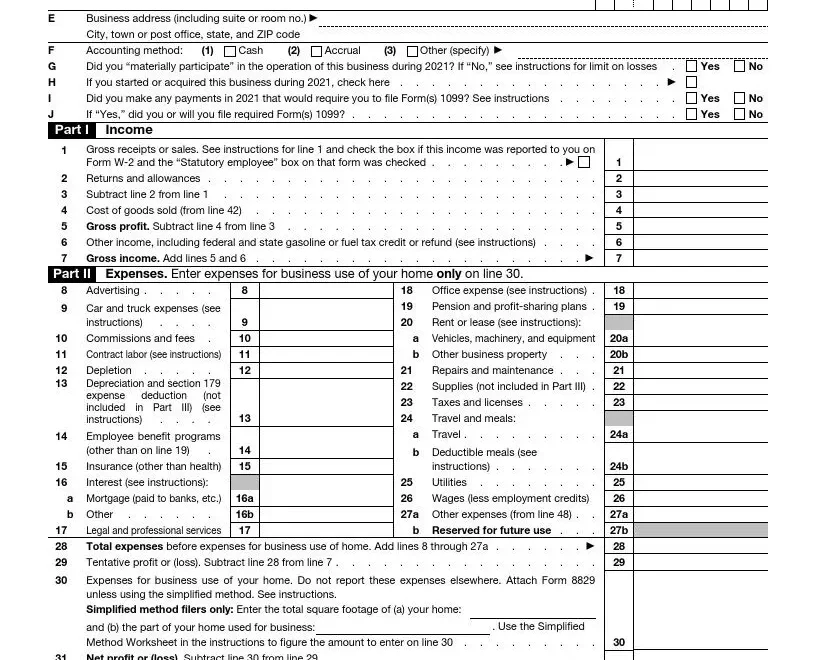

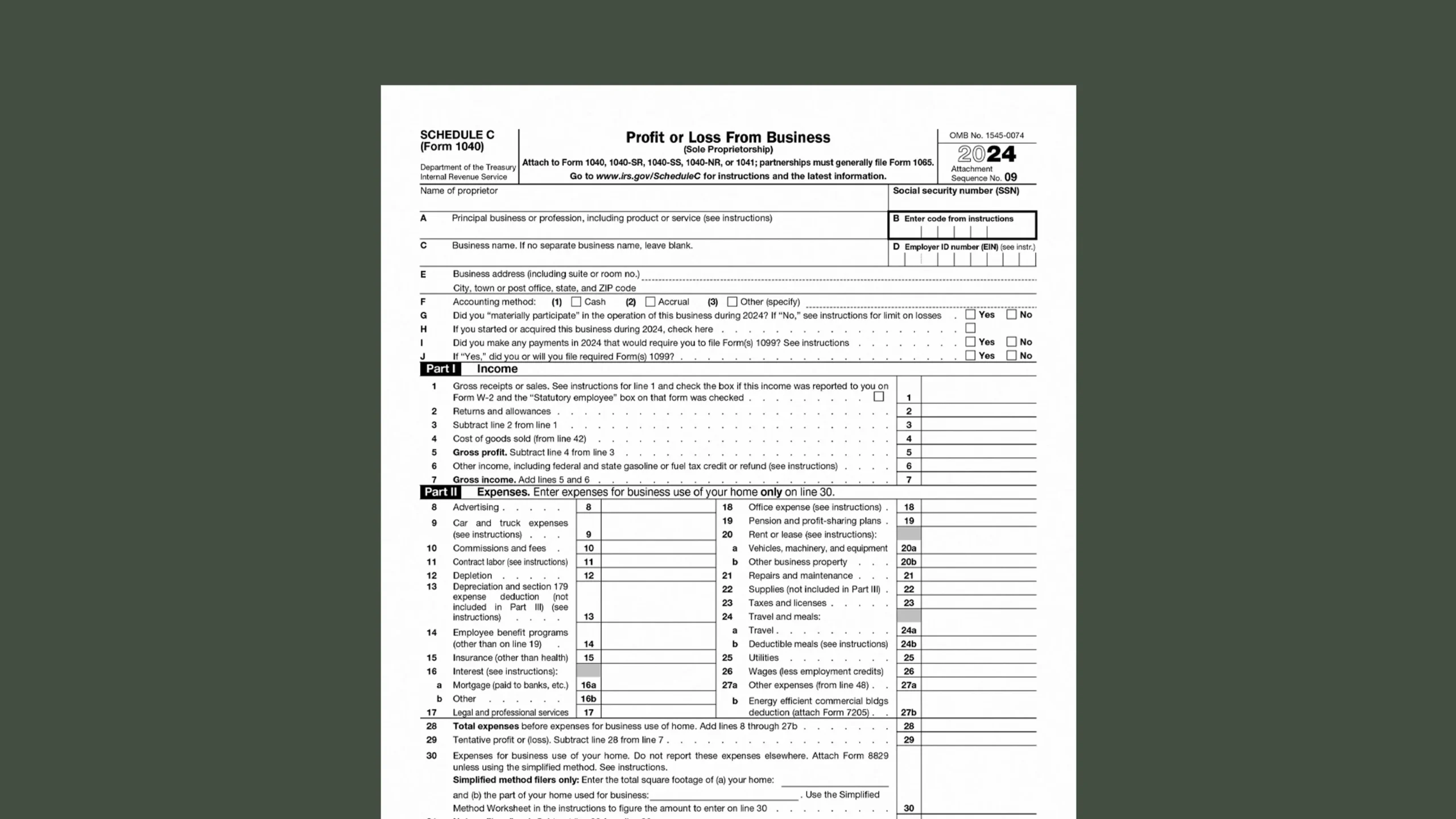

If you’re self-employed or a small business owner, navigating tax season can be overwhelming. Understanding the various tax forms, including the Printable Tax Form 1040 Schedule C, is crucial to ensuring you file your taxes correctly.

The Printable Tax Form 1040 Schedule C is used to report income or loss from a business you operated as a sole proprietor or as an independent contractor. It’s an essential form for those who need to report their business income, deductions, and profits.

Printable Tax Form 1040 Schedule C

Understanding the Printable Tax Form 1040 Schedule C

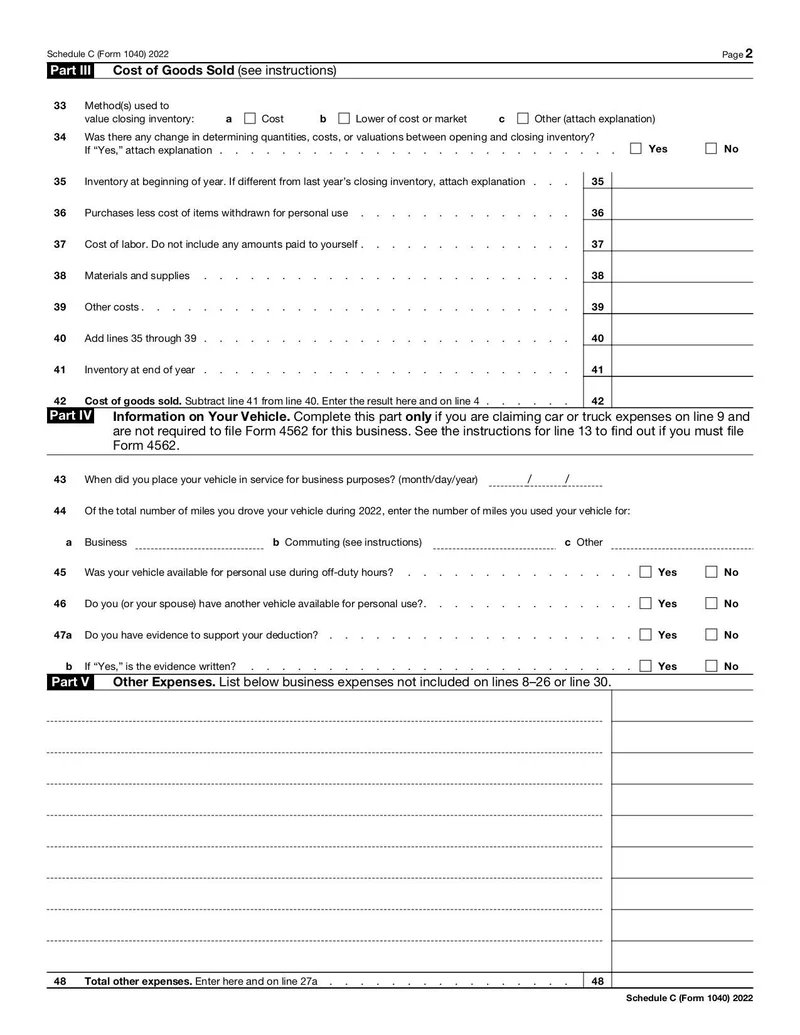

When filling out the Printable Tax Form 1040 Schedule C, you’ll need to provide information about your business, such as the type of business you have, its income and expenses, and any deductions you’re eligible for. It’s important to keep accurate records to ensure accurate reporting.

One of the key benefits of using the Printable Tax Form 1040 Schedule C is that it allows you to deduct business expenses from your taxable income. This can help lower your overall tax liability and save you money in the long run. Make sure to take advantage of all eligible deductions.

It’s important to review the instructions for the Printable Tax Form 1040 Schedule C carefully to ensure you’re filling it out correctly. Mistakes or omissions can lead to delays in processing your tax return or potential audits. If you’re unsure about any part of the form, consider seeking advice from a tax professional.

In conclusion, understanding the Printable Tax Form 1040 Schedule C is essential for self-employed individuals and small business owners. By accurately reporting your income, expenses, and deductions, you can ensure compliance with tax laws and potentially reduce your tax liability. Be diligent in filling out the form and seek help if needed to avoid costly errors.

A Step by Step Guide To Filing Schedule C Form 1040 Ambrook

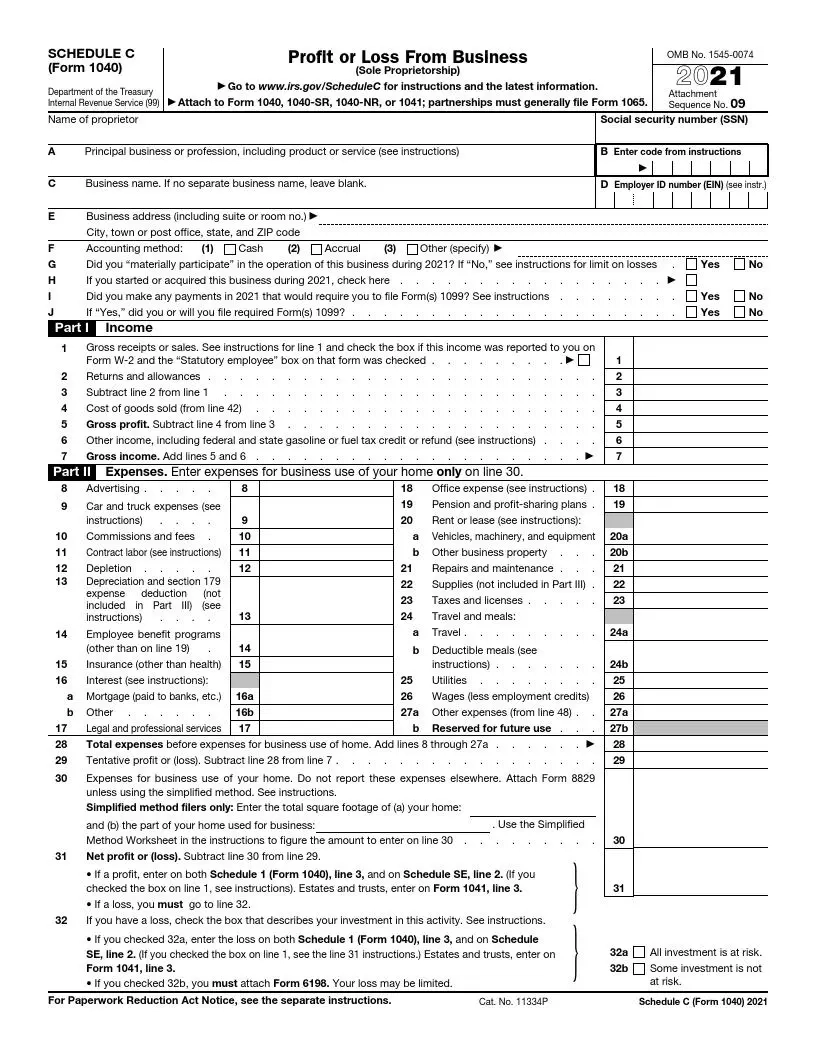

1040 Schedule C Form Fill Out IRS Schedule C Tax Form 2021