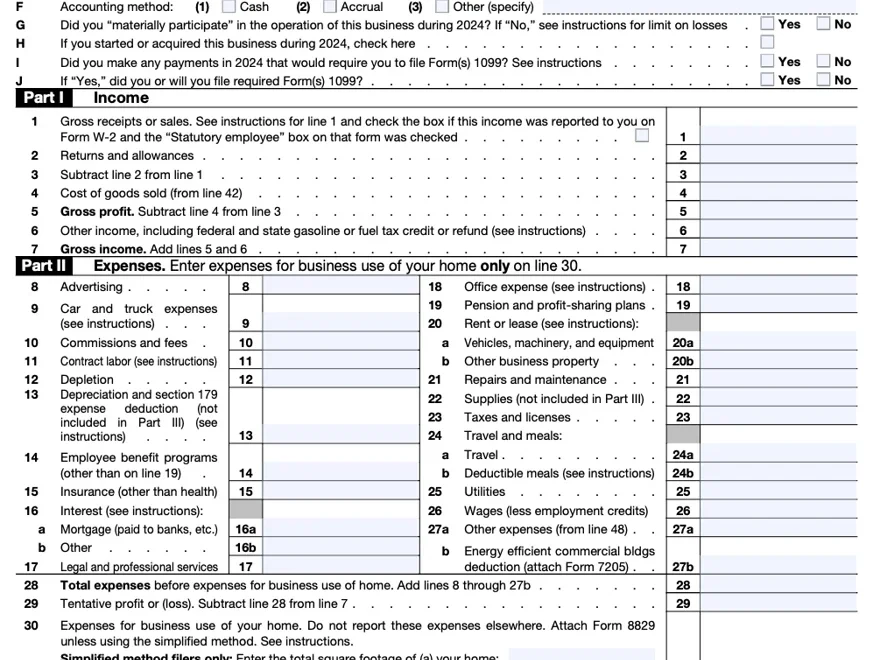

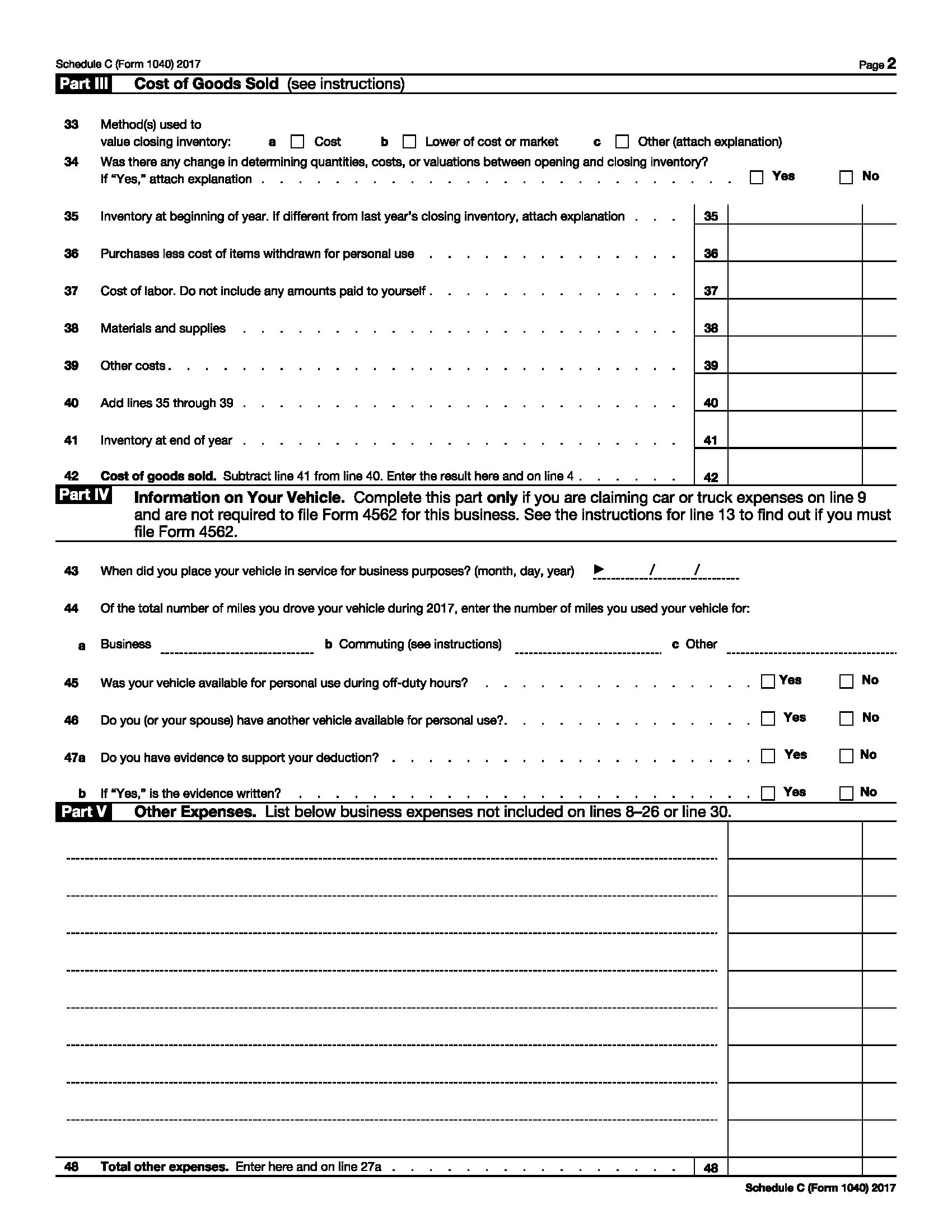

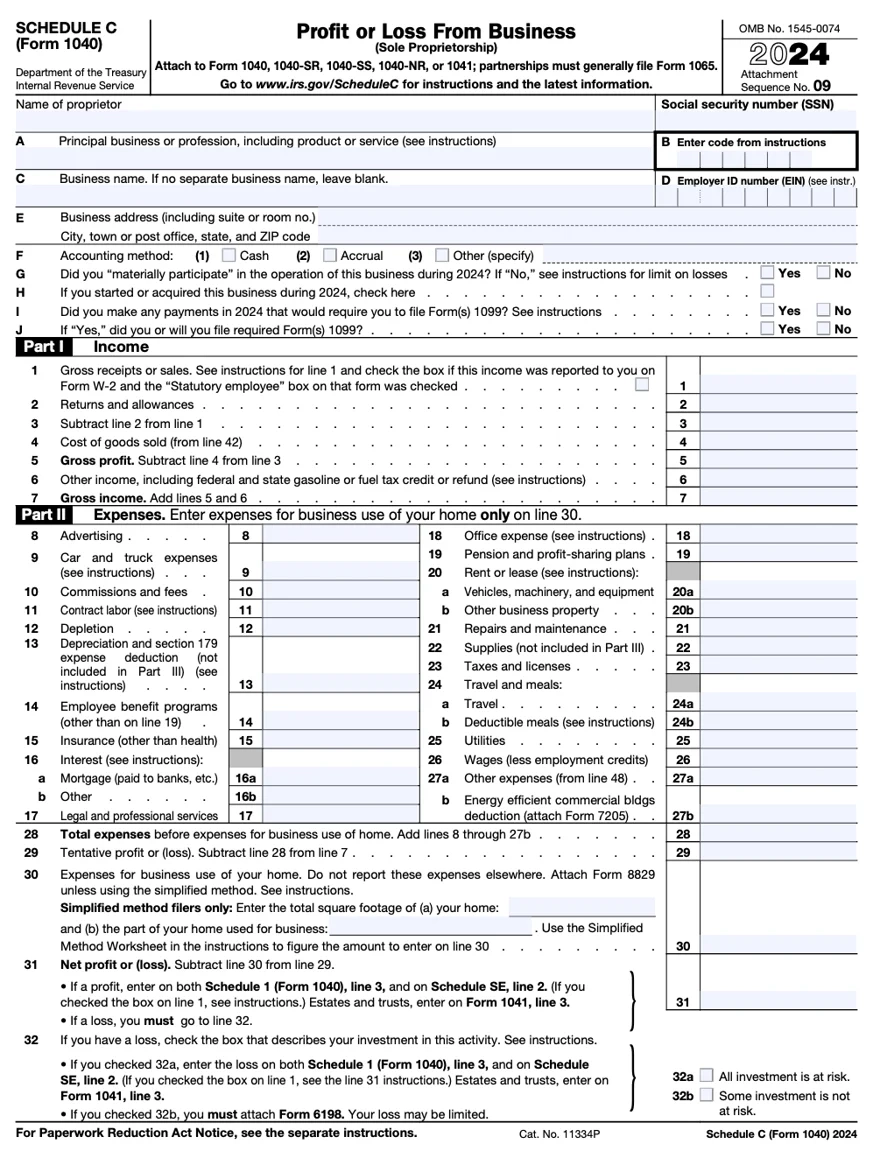

Are you looking for an easy way to file your taxes for 2026? One option is to use a printable Schedule C Form 1040. This form is used by self-employed individuals to report their business income and expenses.

By filling out the Schedule C Form 1040, you can calculate your net profit or loss from your business, which will be included on your overall tax return. This form is essential for freelancers, contractors, and small business owners.

Printable Schedule C Form 1040 2026

Printable Schedule C Form 1040 2026

When completing the Schedule C Form 1040, make sure to accurately report all sources of income and deductible expenses related to your business. Keep records of your business transactions throughout the year to ensure accuracy.

It’s important to note that the IRS may require additional documentation to support the figures reported on your Schedule C Form 1040. Be prepared to provide receipts, invoices, and other financial records if requested.

Using a printable Schedule C Form 1040 for your 2026 taxes can help streamline the filing process and ensure that you are reporting your business income and expenses accurately. Remember to consult with a tax professional if you have any questions or concerns.

In conclusion, the printable Schedule C Form 1040 is a valuable tool for self-employed individuals to report their business income and expenses for the 2026 tax year. By carefully completing this form and keeping accurate records, you can simplify the tax filing process and avoid potential issues with the IRS.

3 21 3 Individual Income Tax Returns Internal Revenue Service

Schedule C The College Investor