Managing your finances can sometimes feel overwhelming, but having a clear picture of your cash flow can make a big difference. One way to do this is by using a Printable Personal Cashflow Sheet.

This simple tool allows you to track your income and expenses easily, helping you make informed decisions about your finances. Whether you’re saving for a big purchase or trying to pay off debt, a cash flow sheet can be a valuable resource.

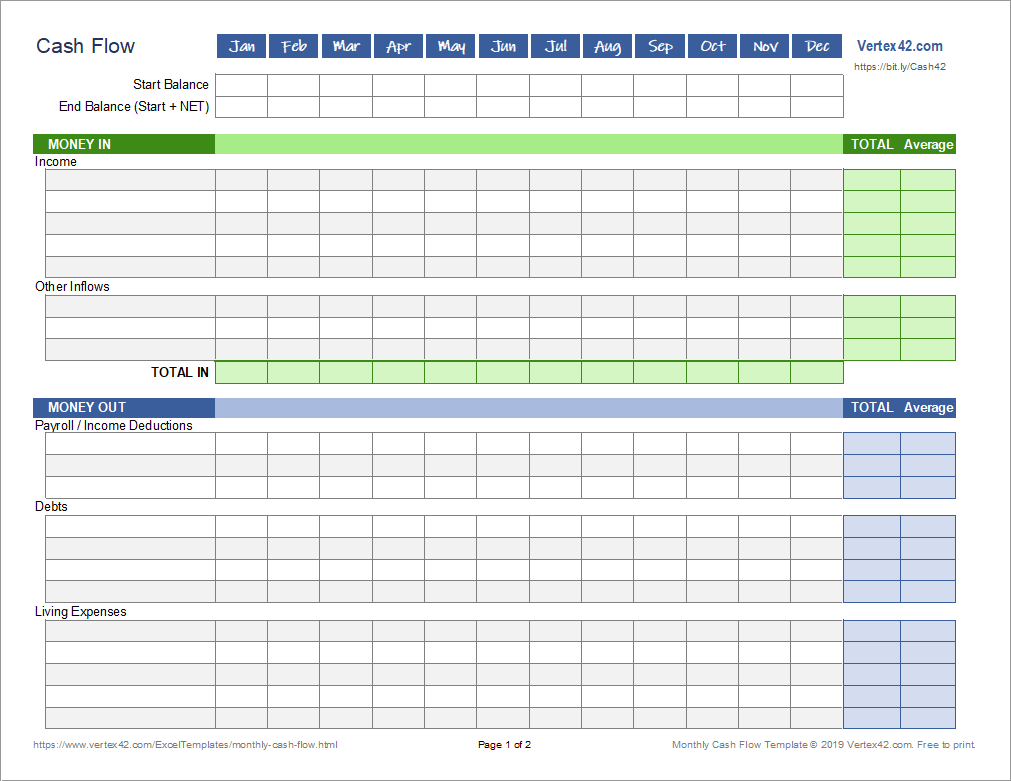

Printable Personal Cashflow Sheet

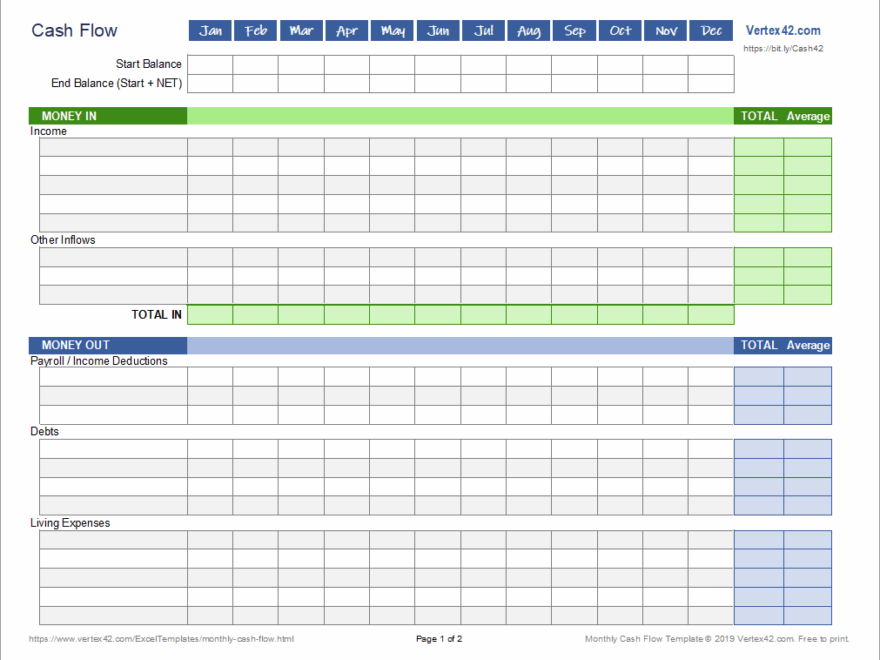

Printable Personal Cashflow Sheet

Creating a Printable Personal Cashflow Sheet is easy. Start by listing all your sources of income, such as your salary, freelance work, or any other money you receive each month. Then, list all your expenses, including rent, utilities, groceries, and any other regular payments.

Once you have all your income and expenses listed, subtract your total expenses from your total income to determine your cash flow. This will give you a clear picture of how much money you have left over each month, which you can then allocate towards savings, investments, or paying off debt.

By regularly updating your Printable Personal Cashflow Sheet, you can track your financial progress over time and make adjustments as needed. This tool can help you identify areas where you can cut back on spending or find ways to increase your income, ultimately helping you reach your financial goals.

Remember, managing your finances is a journey, and using tools like a Printable Personal Cashflow Sheet can make that journey a little easier. By taking control of your cash flow, you can feel more confident about your financial future and make informed decisions about your money.

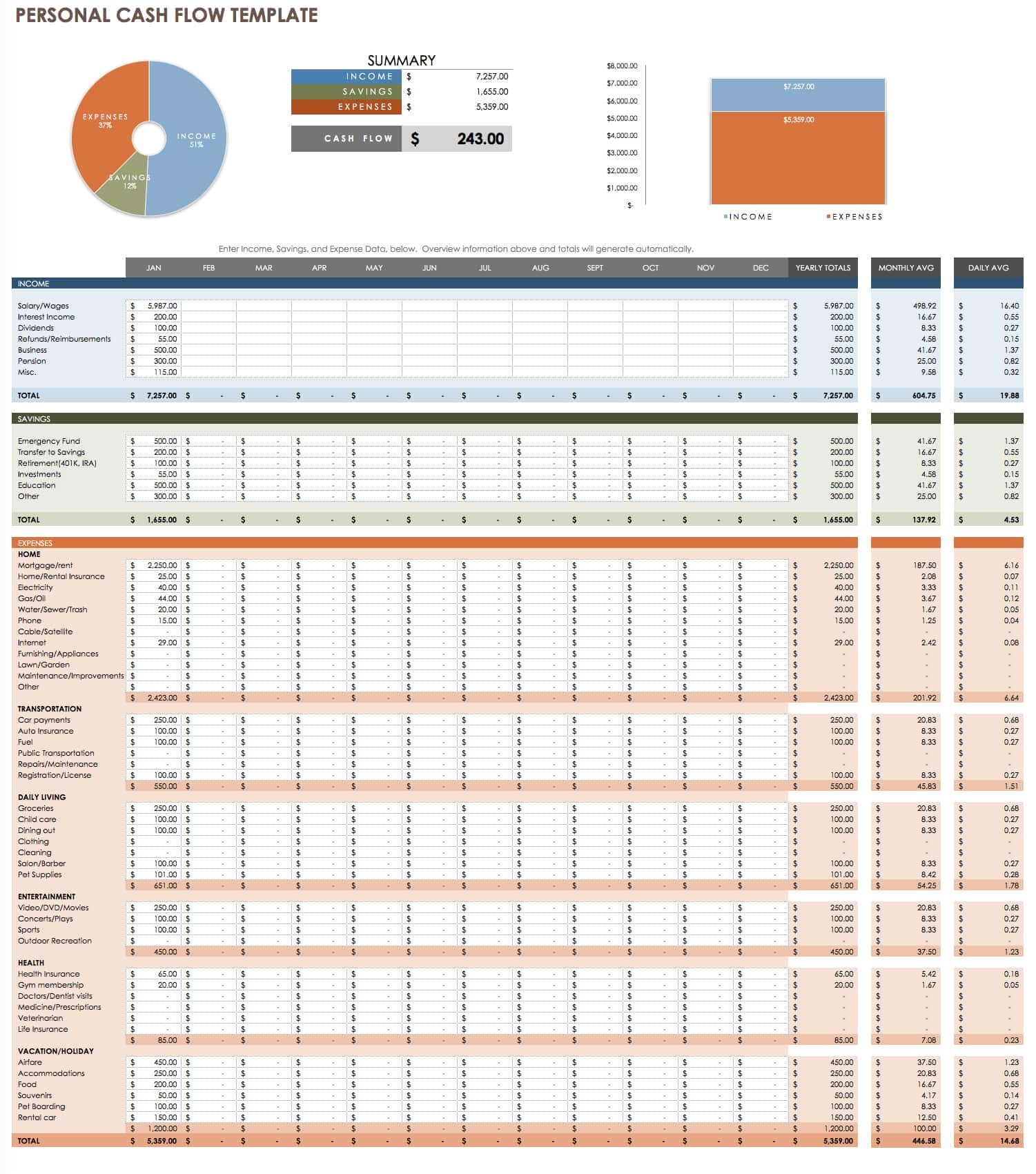

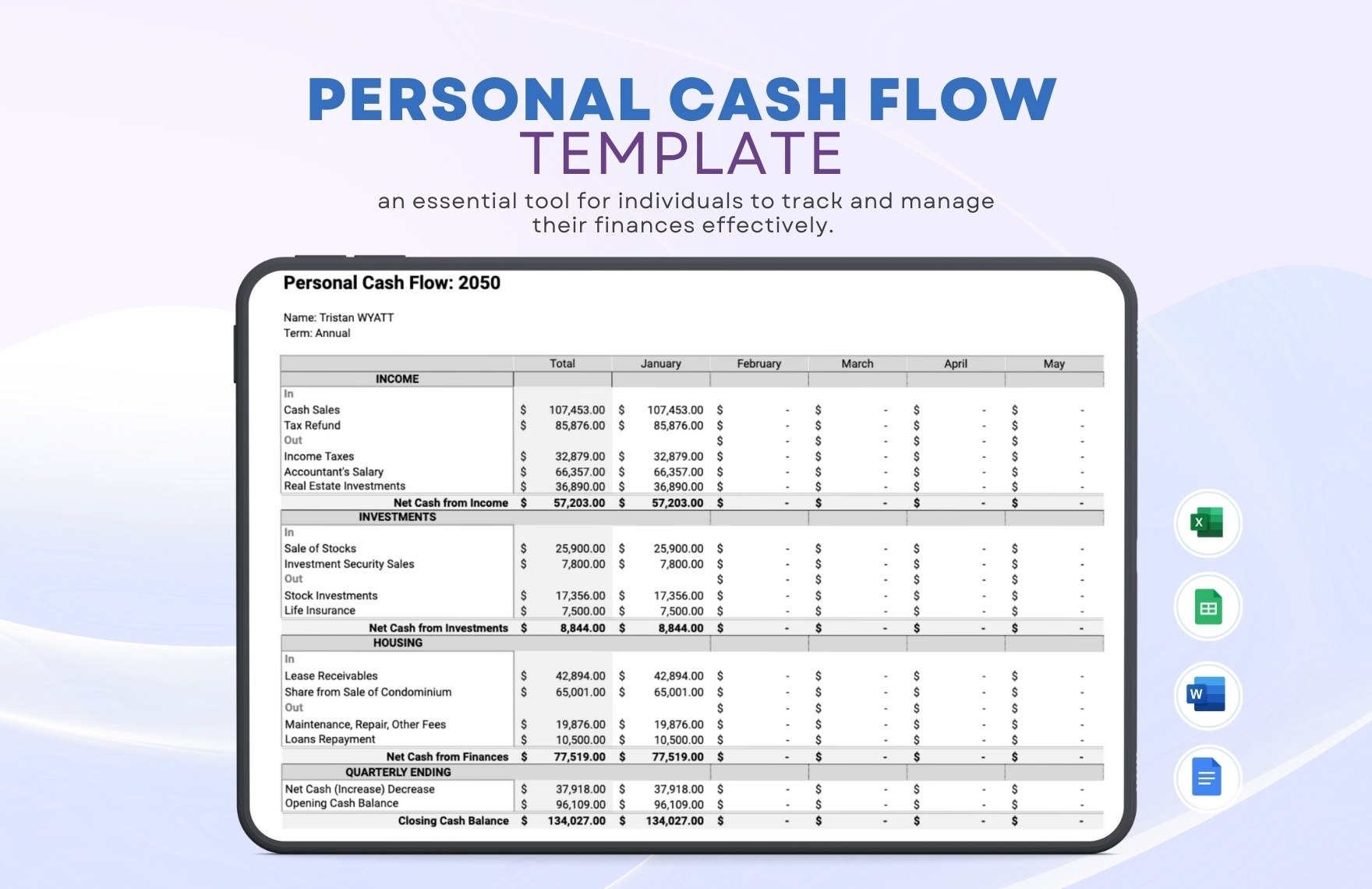

Personal Cash Flow Template In Excel Google Sheets Word Google

Monthly Cash Flow Worksheet For Personal Finance