Are you a freelancer or independent contractor looking for an easy way to file your taxes? Look no further than the Schedule C Form Printable. This form is a straightforward document that allows you to report your income and expenses for your business.

Whether you’re a gig worker, small business owner, or self-employed individual, the Schedule C Form Printable is an essential tool for accurately reporting your earnings. By filling out this form, you can ensure that you are compliant with IRS regulations and avoid any potential penalties.

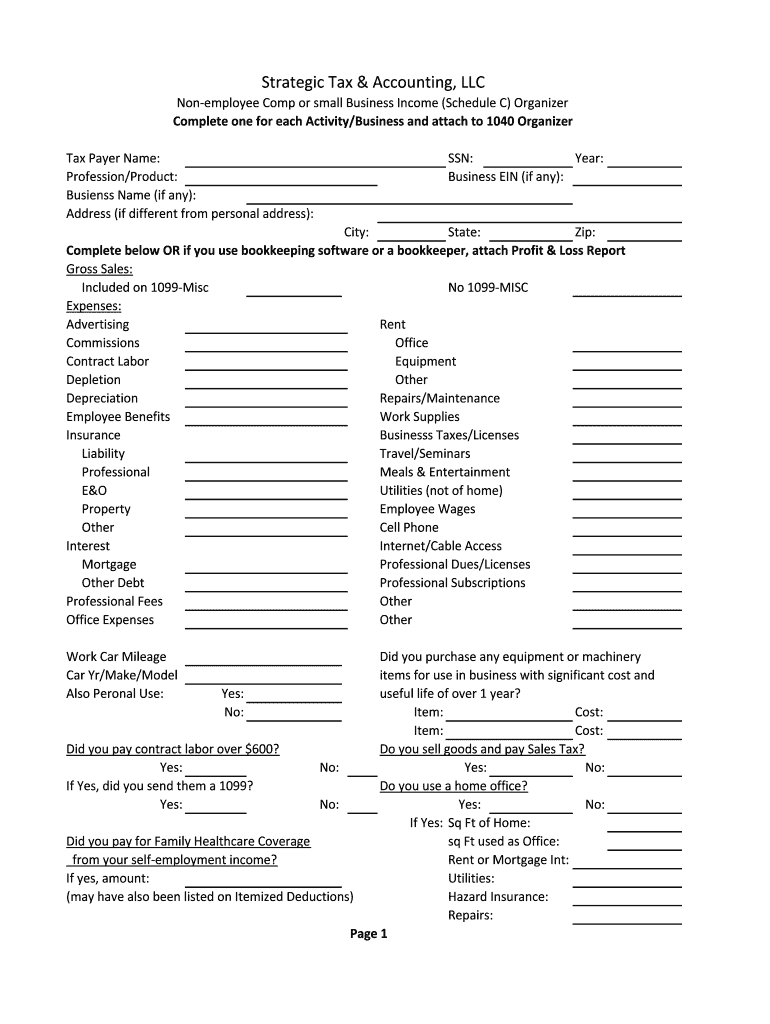

Schedule C Form Printable

Effortlessly File Your Taxes with Schedule C Form Printable

Simply download the Schedule C Form Printable from the IRS website, fill in your business details, income, and expenses, and you’re ready to go. This form is designed to be user-friendly, making it easy for even first-time filers to complete their taxes accurately.

Once you have filled out the Schedule C Form Printable, you can submit it along with your other tax documents to the IRS. By including this form in your tax return, you can ensure that you are reporting your business income and expenses correctly, minimizing the risk of an audit.

Don’t let tax season stress you out. With the Schedule C Form Printable, you can streamline the process of filing your taxes and focus on what you do best – running your business. Take the hassle out of tax season and download this form today to get started on your taxes.

In conclusion, the Schedule C Form Printable is a valuable resource for freelancers and small business owners looking to file their taxes accurately. By using this form, you can simplify the process of reporting your income and expenses, ensuring that you remain compliant with IRS regulations. Say goodbye to tax season headaches and hello to a stress-free filing experience with the Schedule C Form Printable.

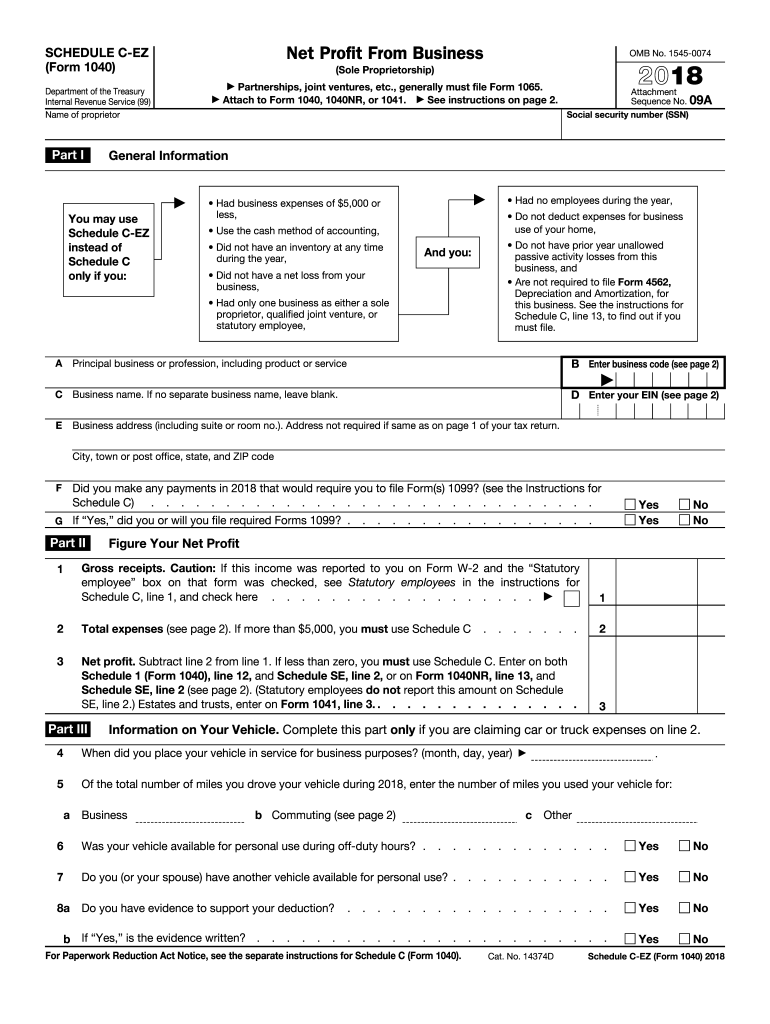

2018 2025 Form IRS 1040 Schedule C EZ Fill Online Printable

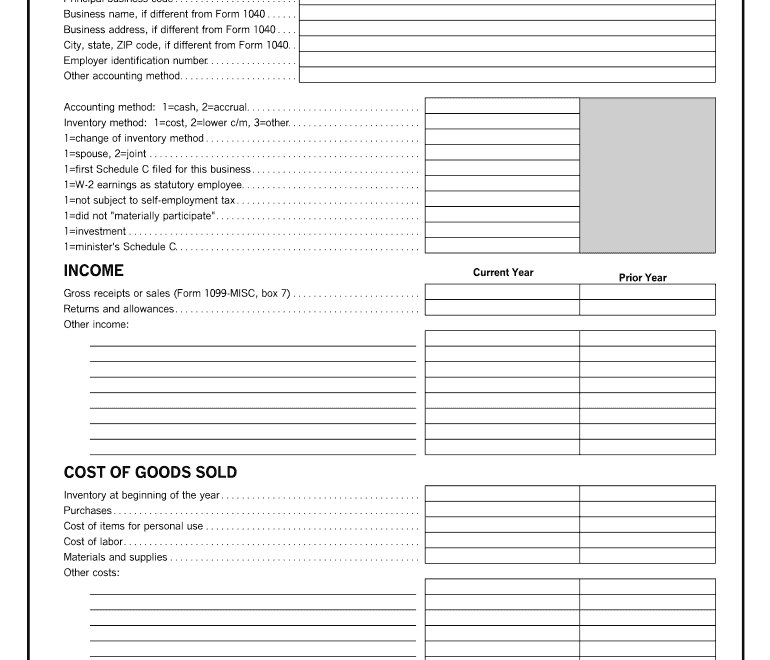

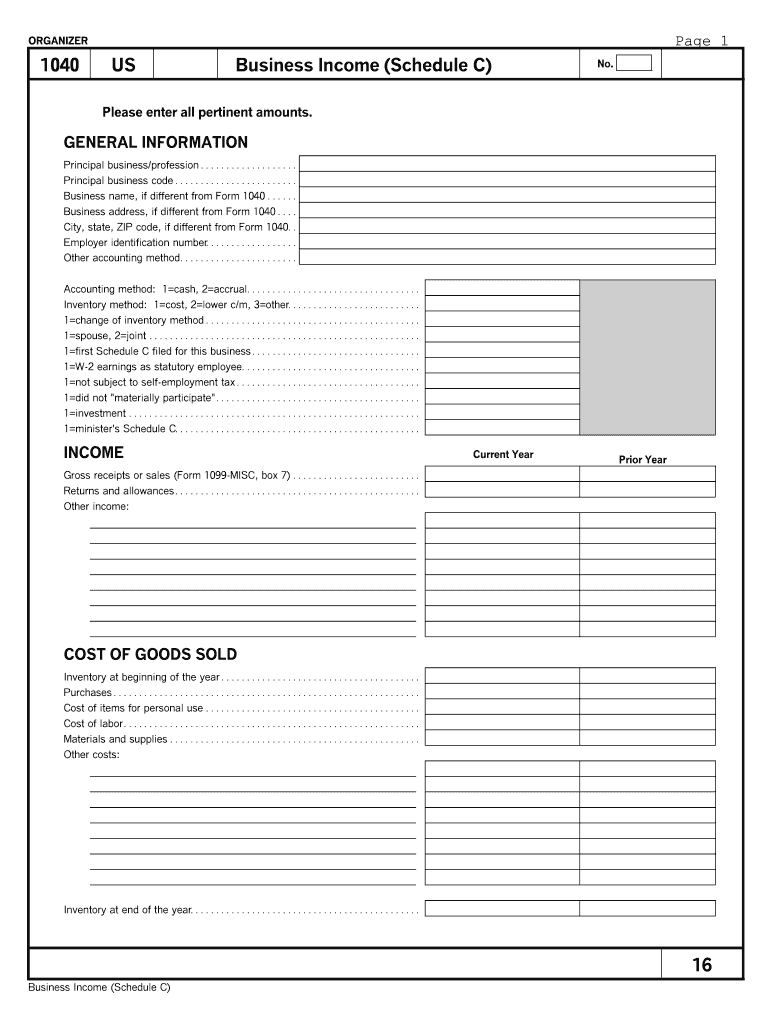

Business Income Schedule C Form Fill Online Printable Fillable