Are you looking for a convenient way to keep track of your business expenses for tax purposes? Well, look no further! Printable forms of Schedule C 2026 are here to help you organize your financial information in a clear and concise manner.

By utilizing a printable form of Schedule C 2026, you can easily input all your income and expenses related to your business. This form is designed to streamline the process of reporting your business finances and ensuring that you are fully compliant with tax regulations.

Printable Form Of Schedule C 2026

Printable Form Of Schedule C 2026

With the printable form of Schedule C 2026, you can categorize your expenses into different sections such as advertising, supplies, utilities, and more. This makes it easier for you to calculate your net profit or loss for the year and report it accurately on your tax return.

Whether you are a freelancer, independent contractor, or small business owner, keeping accurate records of your business expenses is crucial. The printable form of Schedule C 2026 simplifies this process and allows you to stay organized throughout the year.

By using the printable form of Schedule C 2026, you can save time and reduce the stress of tax season. Instead of scrambling to gather all your financial documents at the last minute, you can have everything neatly organized and ready to go.

In conclusion, utilizing a printable form of Schedule C 2026 is a smart choice for any business owner looking to stay on top of their finances. By keeping detailed records of your income and expenses, you can ensure that you are prepared for tax season and avoid any potential issues with the IRS.

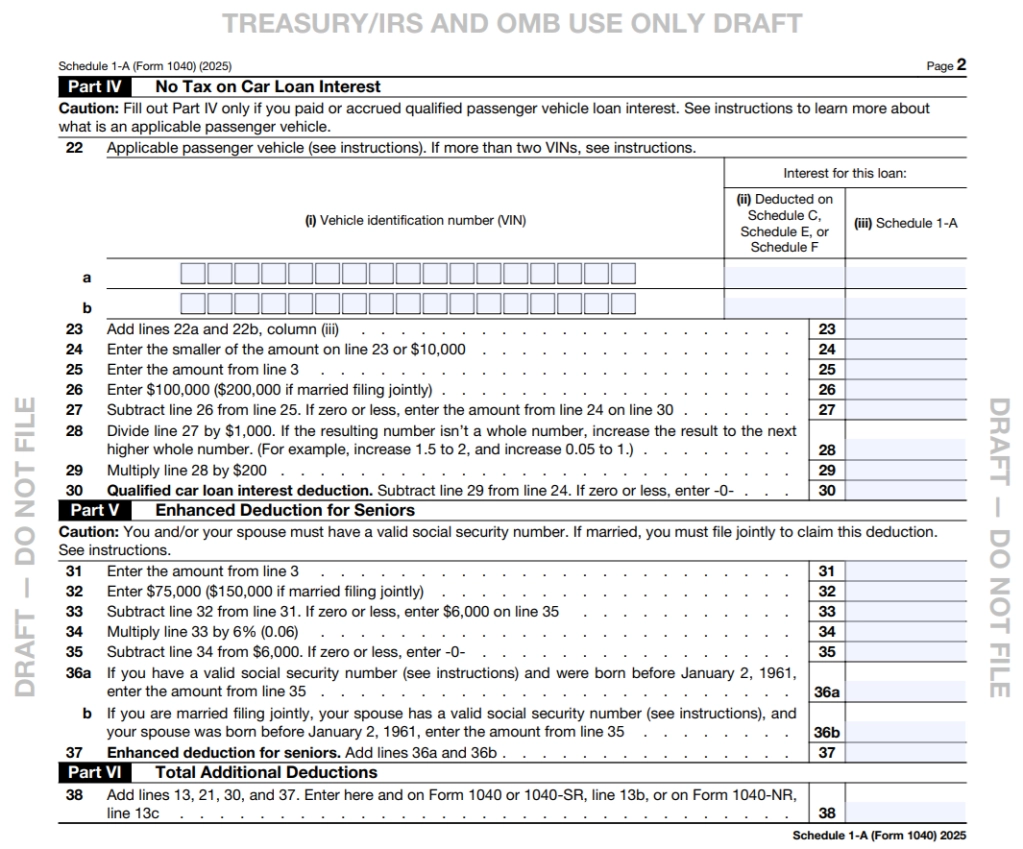

IRS Provides Glimpse Of Schedule 1 A Form For New OBBBA Tax Deductions CPA Practice Advisor

10 Key IRS Tax Forms Schedules And Publications For 2026 FormPros